-

-

-

-

-

Government of Indonesia –Baa2 stable

January 30, 2024 -

-

-

Government of Egypt – Caa1 stable

November 8, 2023 -

Strong Q3 results set scene for further profitable growth

November 6, 2023 -

-

Economic diversification agendas and growing demand will buoy profits

September 27, 2023 -

Market volatility and inflation are CIOs’ key concerns

September 26, 2023 -

Rising demand supports profitable takaful growth

September 26, 2023 -

Islamic fintechs are gaining a foothold after a slow start

September 26, 2023 -

-

Diversified growth reinforces the UK’s Islamic finance ecosystem

September 4, 2023 -

-

Government of Malaysia – A3 stable

June 20, 2023 -

-

-

Moody’s sovereign Sukuk primer — Saudi Arabia

April 28, 2023 -

-

-

-

-

-

Jumps in funding costs amid liquidity stress will strain profitability

February 22, 2023 -

Morocco’s Islamic banking system

February 21, 2023 -

Kenya’s Islamic banking system

February 21, 2023 -

Egypt’s Islamic Banking system

February 21, 2023 -

Nigeria’s Islamic banking system

February 21, 2023 -

Moody’s sovereign Sukuk primer — Maldives

December 17, 2022 -

Moody’s sovereign Sukuk primer — Sharjah

October 6, 2022 -

-

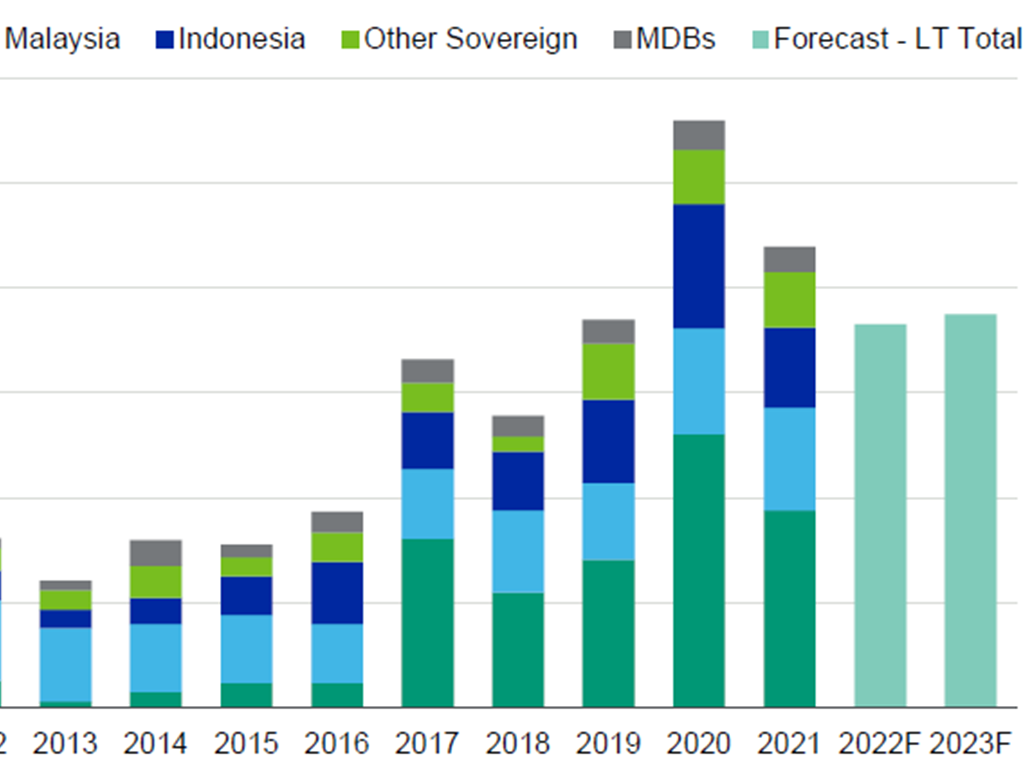

Sukuk issuance to remain under pressure

September 12, 2022 -

High commodity prices will sustain the recovery of Islamic banks

September 8, 2022 -

Quarterly EM Issuance Monitor – Q2 2022

July 27, 2022 -

-

-

Moody’s sovereign Sukuk primer — Pakistan

June 20, 2022 -

-

-

-

Moody’s sovereign Sukuk primer — Turkey

March 25, 2022 -

-

-

-

-

Islamic banking will remain a niche but innovative market in South Africa

September 28, 2021 -

Takaful insurers’ deteriorating H1 profit highlights challenges

September 20, 2021

Proprietary Rights Notice

© 2024, Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. And/or their licensors and affiliates (collectively, “Moody’s”). All rights reserved. Moody’s research and other information (“Moody’s Information”) is proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to IFN by Moody’s. Moody’s information may not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person without Moody’s prior written consent. Use of Moody’s Information is subject to the additional terms and conditions set forth at https://www.moodys.com/Pages/globaldisclaimer.aspx and by your use of it, you agree to such terms and conditions. Moody’s® is a registered trademark.