In the past two years there has been a surge in the number of high-profile Sukuk instruments issued in the GCC and South-East Asia, yet none had originated from the Kingdom of Saudi Arabia until the issuance of the SABIC Sukuk. This is despite the Kingdom having the largest domestic capital market of all of the GCC countries (in terms of market capitalization of its stock exchange) and, moreover, that it has been a pioneer in the establishment and development of Islamic banking and finance. It is a major member country of the Organisation of Islamic Cooperation (OIC) and the Islamic Development Bank (IDB) – to which it is the host country – it is home to the world’s largest Islamic bank (in terms of assets) and, through private initiatives, was behind the establishment in the 1970s of two of the major international Islamic banking conglomerates.

The SABIC Sukuk was issued on the 29th July 2006, and anticipation accompanying the issue was considerable, as it was the first time that Saudi nationals and residents were able to invest in a local currency, fixed income instrument that had been vetted by the Shariah Supervisory Committee of a Saudi Arabian Bank (SABB Amanah). As would naturally occur with a first-time issuance, SABIC and its lead manager HSBC had set the platform for Sukuk issuance in the Saudi Arabian market. This involved preparing the offering documents to high international standards and addressing a number of issues, some of which are described in this brief case study.

Shariah and structuring

The challenge in structuring the Sukuk was to obtain approval from a Saudi Arabian Shariah committee on a Sukuk structure – something that no previous Sukuk issued had achieved. A further challenge was that SABIC is a holding investment company with few tangible assets, aside from its equity investments in its affiliates.

The Sukuk assets represent an investment, for 20 years, in limited rights and obligations of SABIC in certain marketing contracts that underpin the marketing services that SABIC provides to its manufacturing affiliates. SABIC itself is a holding company which has an equity stake in many affiliate companies that produce petrochemicals, steel and fertilizers (and other intermediate goods). In addition to being a holding company, managing and coordinating its investments, SABIC itself has a research and technology unit (holding over 200 registered patents) and a marketing business unit. Its marketing unit undertakes the service of marketing and selling the products of certain of its affiliates to companies located in Saudi Arabia and across the globe to over 100 countries. This marketing unit incurs certain costs (the costs of marketing and selling products to thousands of global customers) and receives fees in return for conducting these services. The scope of its marketing and selling activities are documented in marketing agreements signed between SABIC and its affiliates.

The marketing unit has an established history of providing exemplary service and earning significant net revenues for SABIC, as marketing fees earned are based upon sales levels achieved. As the SABIC group’s own net income is based upon sales of the group, the marketing services income represents a good proxy for SABIC corporate risk.

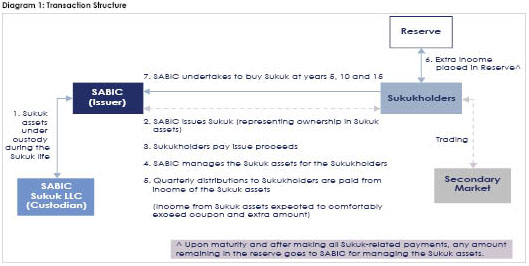

The structure of the Sukuk entitles Sukuk holders, for 20 years, with a right in the defined net income from these marketing services subject to certain terms and conditions outlined in the Sukuk offering circular. The net income derived from this investment is paid quarterly to Sukuk holders, up to a specific amount (based on a benchmark linked to SIBOR) and surplus income is kept as a reserve. The reserve is used as a buffer protection to safeguard Sukuk holders in the unlikely event that net income for any period unexpectedly falls below the specific amount.

In addition to acting as a buffer, money accruing to the reserve is used to pay, every 5 years throughout the 20-year life of the Sukuk, an extra amount equal to 10% of the face value of the Sukuk. Thus, by the end, an amount of 40% of the face value (as well as the quarterly return) would have been paid to Sukuk holders. Also, at the end of the Sukuk’s life – whether 20-years or earlier if the Sukuk is purchased by SABIC before then – any remaining balance in the reserve is paid to SABIC as an incentive. The rationale for paying this is to provide SABIC with a strong incentive to continue providing the marketing services to a high and profitable standard.

Therefore, if the Sukuk holders exercise their option for SABIC to purchase the Sukuk at the end of year 5, they will receive an aggregate of 100% of the face value; 90% as a purchase price and a 10% extra amount. If Sukuk holders choose not to sell to SABIC at the end of the first five years (SABIC has no option to refuse, it is the right of Sukuk holders), the aggregate amount receivable declines to 80% in year 10, 60% in year 15 and just 40% in year 20.

Distribution and trading of the Sukuk

As there was no precedent in the market, the trading mechanism for the Sukuk had to be formulated from scratch with the domestic stock market (Tadawul) and the mechanism was tested with other market-making banks before the launch to guarantee smooth trading in the secondary market. The system used was Tadawul’s existing Equator platform where trades are matched electronically. Since the launch, trading in the secondary market has been active and has been increasing in volume.

Conclusion

The SABIC Sukuk is an important step in the development of the Sukuk as a viable Shariah compliant financial instrument. It has a firm basis in Islamic Shariah, being modelled on an investment in an existing business activity, yet achieves a credit risk profile familiar to sophisticated capital markets investors.

It is hoped that this Sukuk structure and this issuance will herald the further development of the Kingdom’s capital markets, efficiently bringing together the vast capital resources that have blessed the Kingdom with efficient and profitable users of capital such as SABIC.

The authors Hissam Kamal and Sheikha Al Sudairy are from HSBC Amanah. The views expressed in this article are those of the authors and not of HSBC.

| Saudi Basic Industries Corporation | |||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||