A structured fund is defined as investing in equity and fixed-income products to provide investors with of both capital protection and capital appreciation. DR NATALIE SCHOON examines further.

Capital protection is achieved by investing part of the funds in fixed-income securities which repay the principal plus interest at maturity.

The remainder of the funds are invested in a combination of options, futures and other derivatives which provide the potential of capital appreciation, with potential losses limited to the premium paid. The derivative instruments are generally linked to a market index providing exposure to equity. Depending on the level of protection and the desired asset class exposure, these funds can be structured in a variety of ways.

The illustration on chart 1 provides an example of how a structured fund might perform.

Starting with an investment amount of US$100 million, 80% is invested in fixed income instruments paying US$1 million in interest over the investment period.

Although structured to return at least 80% of the original investment at the end of the period, there is a chance that this may not be fully achieved. The different scenarios in the illustration are not exhaustive and any combination of returns is technically possible.

The attraction of structured funds for investors lies in the potential upside that can be achieved whilst still maintaining a reasonable level of capital protection. This protection does, however, come at a cost to the investor. In order to achieve capital protection, a significant amount of funds need to be invested in low risk, low return instruments which reduces the potential loss to the fund, but equally reduces the potential profits that can be achieved.

For investors with a relatively low risk appetite, a structured fund provides a good alternative investment which is the same for both conventional and Islamic investors. The prohibition on derivative instruments in

Shariah, however, does not mean that a structured fund is not possible. Considering the two parts of the structure,

Shariah compliance can be achieved in different ways.

-

Capital Protection – A level of capital protection can be achieved by investing in instruments with a high probability of returning the capital as well as a return. Potential instruments that can be applied are commodity

Murabahah, highly rated

Sukuk, and leasing transactions. Each of these has different risk return profiles and their suitability will be decided by the fund manager taking into consideration the risk appetite of the fund and the general parameters.

Sukuk held for the purpose of achieving capital protection are most likely held to maturity in order to circumvent any potential impact of price volatility.

-

Capital Gains – As indicated above, conventional structured funds typically use a mixture of different types of derivative instruments including options and futures. These instruments are typically not available to

Shariah compliant fund managers, but a number of other instruments can be used to enhance the return of the fund. In addition, many of the funds have some form of optionality built in which is achieved by the application of an Arbun contract.

Case study: An Najah NID-i

An Najah fund is managed by

Bank Islam Malaysia (

BIMB), a fully

Shariah compliant bank incorporated in Malaysia in 1983 and regulated by

Bank Negara Malaysia.

BIMB offers a wide range of services across retail and corporate banking. The fund is managed by

BIMB Unit Trust Management (BUTM).

An-Najah NID-i is an Islamic Negotiable Instruments (INI) fund based on the structure of a

Mudarabah Muqayyadah (restricted

Mudarabah) and conforms to the

Bank Negara Malaysia guidelines on Islamic Negotiable Instruments of 2000. The investment term is three years, during which the investor’s capital is fully guaranteed with additional return potential linked to the performance of the top 30 global stocks selected from the

Dow Jones Islamic Market World Index (DJIMW), which has a total investment universe of 2,400 stocks. The key features of the fund can be summarized as follows:

-

Fully capital-protected as long as the investment is held to maturity, redemptions prior to maturity will be subject to prevailing market conditions at the time;

-

Potential additional returns are achieved through the SGAM Baraka Aging Population Index across the health care and consumer services sectors from the DJIMW;

-

Global diversification across industries and sectors;

-

Active investing and portfolio rebalancing strategy;

-

Profits are shared using the ratio of 99.9% for investors and 0.1% for

BIMB;

-

Three year investment term from the 6th October 2008 until the 6th October 2011.

The fund currency is Malaysian Ringgit (RM) and has a minimum investment amount of RM50,000 and any investment must be a multiple of RM50,000. Subscription and redemption frequencies are 2 – 6 days. The fund is not listed on the exchange. Due to the fact that the fund is denominated in RM and aimed at Malaysian investors, there is no currency risk, even though the exposure is global.

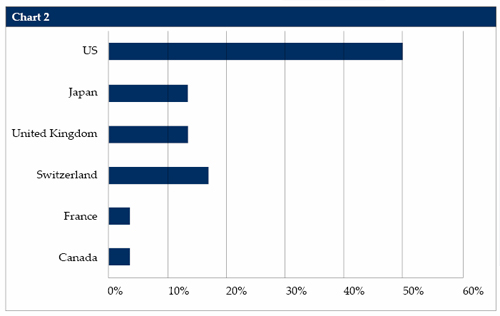

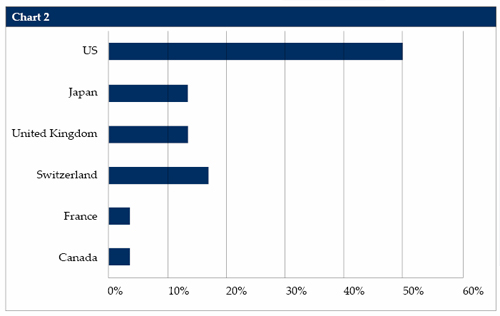

The exact asset allocation is not disclosed, but the most recent factsheet shows that the fund is diversified across the healthcare sectors with global exposure as in chart 2.

Providing up-to-date performance data is outside the scope of this article, and in any case investors need to satisfy themselves with the suitability of an investment to meet their needs prior to making an investment decision. Performance is subject to change due to, for instance, market circumstances, and developments internal to the fund. The impact of market circumstances clearly shows from the performance data in the most recent factsheet which indicates that in the first four months of the fund’s incorporation the performance of the associated index remained below its base of 100, with a low of 81.05 in March 2009. Only since September 2009 did the related index exceed 100. On the 6th April 2011, the index had reached a level of 115.76. Over the period from 6th October 2008 to the 29th April 2011, the overall performance was reported to be as on chart 3.

Conclusion

Although the exact asset allocation of the fund is not reported, it would be reasonable to assume that the structure includes a

Murabahah transaction which allows for the fund to guarantee the capital in combination with an investment in the associated index either directly or via a wa’d which may result in achieving additional revenues for the investor depending on the performance of the associated index. Clearly past performance is no guarantee for the future and although at the moment it appears that the investors will receive a return in excess of their original investment, this is by no means a certainty, even though there is only a short period remaining until the maturity of the investment. In addition, the overall perception is that this fund performs in line with any comparable conventional fund that would use a similar benchmark, and has a similar management fee associated with it as a conventional structured fund with the same criteria, which clearly shows from the Bank’s profit share, which is 0.1%.

Dr Natalie Schoon is the head of product research at the Bank of London and The Middle East. She can be contacted at

[email protected].