To ensure the sector’s longer-term viability, operators need to improve their ability to retain earnings within the Takaful fund and focus on product differentiation as opposed to competing on price.

Takaful growth strong

In general, Takaful operators in the MENA region are growing quickly with drivers for growth including the introduction of compulsory medical insurance in countries and emirates including Abu Dhabi. Strong oil prices are likely to enable governments to maintain spending on infrastructure and development in the region, and will subsequently result in greater demand for protection. However, ongoing political instability and volatility in commodity prices could dampen this demand.

AM Best has analyzed 131 Takaful operators and conventional insurers in the GCC – the UAE, Bahrain, Saudi Arabia, Oman, Qatar, Kuwait – and Malaysia. There are an estimated 17.1 million Muslims in Malaysia and 36.1 million in the GCC countries. Analysis of Takaful operators compared to conventional insurers in these markets shows that in recent years the Takaful market has grown significantly. Operators have benefited from the introduction of compulsory covers in many of the countries where they operate.

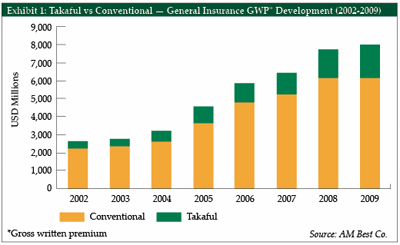

Exhibit 1 shows that the General Takaful business of the companies in AM Best’s sample grew by an average rate of 27% from 2004 to 2009, with gross contributions of US$1.86 billion. This outperformed the 19% rise in total premiums for conventional insurers in these countries.

However, a recent report published by AM Best entitled ‘Takaful poised for growth, but greater focus is required’ found that in most cases this is a consequence of the rapid expansion of the insurance markets in these countries, as opposed to increased demand specifically for Shariah compliant offerings.

Takaful operators engage in conventional business

Takaful operators in the GCC and Malaysia are growing at a rapid pace and those analyzed by AM Best were highly capitalized on a consolidated funds basis. Many operators were in the early stages of operations and have failed to meet original business plans.

As many Takaful operators are start-ups, a number have struggled to meet business plans, particularly those that have tried to be strict in their definition of Takaful business. Many Takaful operators have since become more flexible and are accepting conventional risks, as well as Takaful business. Furthermore, Takaful operators are generally unable to generate sufficient surpluses in Takaful funds as management expenses and fees charged to Takaful funds are high.

Takaful operators’ financial performance tends to be inferior to conventional insurers. Instead of product differentiation being a unique selling point, Takaful operators are often competing on price.

With regards to re-Takaful, similarly, the majority of re-Takaful companies are engaged in traditional reinsurance business. In general the re-Takaful market has failed to grow as rapidly as initially expected. While there has been tremendous growth in the primary Takaful market over the past few years, this has not translated into commensurate increased re-Takaful demand because Takaful operators have been utilizing traditional reinsurance capacity.

The growth of the re-Takaful market depends on whether primary Takaful operators come under pressure to alter their reinsurance purchasing patterns and seek Shariah compliant cover for themselves. Industry guidelines on re-Takaful purchasing would enable greater clarity to Takaful operators and could provide this pressure.

Family Takaful expected to be an opportunity

Family Takaful is considered a particular area for growth as it provides the Muslim population with alternative protection and investment opportunities, and the Takaful operators with increased profitability. It offers greater opportunities than General Takaful as the conventional life insurance market remains undeveloped in the GCC and Malaysia. Family business is more profitable than General Takaful.

AM Best’s analysis of the non-life and family sectors in these markets shows that Family Takaful accounts for less than 25% of the contributions received.

General Takaful has grown at a compound annual growth rate of 27% from 2004 to 2009. However, Family Takaful has grown, on average, at a more modest pace (22%) over the same period. Nevertheless, when examining the performance of conventional insurers in the same markets (Exhibit 2), it is evident that Family Takaful operators are growing at a faster rate than the conventional life market, albeit from a low base.

Country risk in Takaful markets

Political instability in the wake of the Arab Spring is currently the most significant risk to Takaful operators in the Middle East. In addition to creating volatility in commodity prices and investment portfolios, it has resulted in industry losses and simultaneously discourages tourism and inward investment.

As part of AM Best’s country risk rating methodology, countries are placed into one of five tiers, ranging from ‘CRT-1’ (Country risk Tier 1), denoting a stable environment with the least proportion of risk, to ‘CRT-5’ (Country risk Tier 5) for countries posing the greatest risk. All GCC countries and Malaysia have an AM Best ‘CRT-3’, which is at the top end of the scale for emerging countries.

Regulation of Takaful needs strengthening

AM Best considers there to be positive developments in several markets because of the introduction of Takaful-specific regulation and minimum capital requirements, including in the UAE, Saudi Arabia, Bahrain, Jordan and Malaysia.

However, in most countries there is still considerable uncertainty as to the priority of liabilities in the case of insolvency of a Takaful company. In many markets the availability of shareholders’ funds to cover any potential deficits in the policyholders’ funds remains unclear. Regulation has yet to be tested regarding the ring-fencing of assets within the Takaful fund and the use of a qard hasan from operators, should the fund become insolvent.

Whilst regulation is weak or non-existent in many countries, in others it is more transparent. In general, capital requirements are set (similar to conventional operators) for the Takaful company, albeit with no requirements for the Takaful fund, with a qard hasan required to cover any policyholder deficit. The rules governing distressed policyholders funds and on winding up a company are extremely important for understanding the underlying liability of operators.

Certain regulatory regimes have much stronger regulation than others, such as in Saudi Arabia and Malaysia, which are at the forefront of Shariah principles and Takaful legislation. Any insurance company operating in Saudi Arabia is equivalent to a Takaful structure and is Shariah compliant. It is a given that the shareholders will be liable and will support the policyholders’ fund.

Even in such a jurisdiction there can still be a lack of surpluses built within the Takaful fund. However, regulation is sufficiently strong to view such companies in the conventional manner. There are set rules regarding the distribution of surplus and fees that can be charged by the operator.

In Malaysia there is an option to operate under a conventional license or Takaful license. Essentially, the Takaful license has been structured based on the conventional regulatory framework and incorporates similar guidelines. There is always a small chance that shareholders may not be liable. According to Malaysian regulation, the liabilities of the policyholders’ fund ranks above shareholders’ fund. Regulation in Malaysia is more advanced and explicit than in other jurisdictions.

AM Best’s analysis of Takaful companies

As one of the key characteristics of a Takaful operation is the existence of two separate funds (the Takaful fund and the operator’s fund), the starting point for assessing the financial strength of a particular insurance company is to apply Best’s capital adequacy ratio (BCAR) proprietary model to the Takaful fund in a way very similar to a mutual company.

AM Best’s Takaful methodology is largely based around the assumption that shareholders will not be liable for any policyholder deficit. The BCAR score for the Takaful fund is therefore said to be the primary driver of balance sheet strength for the overall company.

At present most shareholders see Takaful companies as another way to package insurance and generate business. They tend to compete for the same business as their conventional peers, albeit at higher costs. As such, some Takaful companies only have a small proportion of Takaful contributions, with a high proportion of conventional business. Despite this, all businesses are reported under policyholders’ funds.

AM Best views a Takaful company as one that separates shareholders’ funds from policyholders’ funds on a licensing basis. Those companies that claim to be Takaful and do not report separate funds, are treated as conventional companies with no mention of Takaful.

The qard hasan is an interest free financing provided by the shareholders’ fund to the policyholders’ fund to cover any deficit. The financing is present in many start-up Takaful companies as the policyholders’ fund is often in deficit for several years. AM Best’s methodology gives credit for the qard hasan when the policyholder fund is in deficit.

Mahesh Mistry is the associate director, analytics and Yvette Essen is the director, industry research – Europe and emerging markets at AM Best. They can be contacted at

[email protected]

and

[email protected]

, respectively.