2014 has been a promising year for the growth of the global Sukuk market. The year saw the entry of new sovereign players. SAUD AL NAFISI notes that Sukuk issuances have expanded to new markets while cross-border issuance activity has accelerated with many sovereign issuers viewing Sukuk as an essential tool to accelerate infrastructure funding.

Debut issuances from non-traditional markets such as the UK, Luxembourg, Hong Kong, South Africa and Senegal bodes well for the growth of the Sukuk industry. The government of Sharjah also issued their debut 10-year US$750 million Sukuk setting two milestones: The first debut issuance with a tenor in excess of five years and the first debut issuance in excess of US$500 million. Among the other notable issuances were Pakistan who returned to the market with a US$1 billion five-year paper after a lapse of nine years.

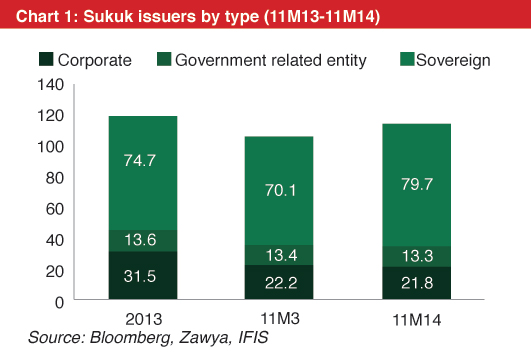

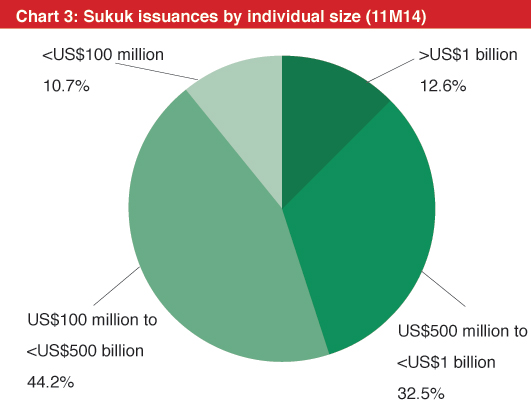

Total sovereign Sukuk issuance in 2014 accounted for 69% of the total US$114.7 billion Sukuk issuances, a 13.7% gain from the US$70.1 billion sovereign Sukuk volume recorded during 2013 (see Chart 1).The growth in Sukuk issuances was accompanied by a deepening of the Sukuk market, with a number of first-time sovereign issuers from 19 different countries tapping the market this year; including landmark issuances from the UK, Hong Kong, Senegal, South Africa, the Emirate of Sharjah and Luxembourg (see Chart 2; see also Chart 3 for individual deal sizes). Sovereign issuers were encouraged to tap into alternative sources of liquidity, amid the increasing acceptance and understanding of Islamic finance globally. The global Sukuk outstanding reached US$300 billion as of 11M14 (January-November 2014), an 11.4% rise from US$269.4 billion for the financial year ending 2013. Malaysia’s secondary Sukuk market is fairly sizeable at approximately US$173.4 billion, a 9.6% increase year-on-year. Meanwhile, the total GCC Sukuk outstanding portfolio grew by 6.4% to US$90.8 billion, as compared to US$85.3 billion outstanding for the financial year ending 2013.

| Chart 2: Top 15 sovereign Sukuk by issuance size (2014) | |||||

| Issuer | Domicile | Structure | Currency | Issue Size | Tenure (Years) |

| Qatar Central Bank | Qatar | Murabahah | QAR | 1,921.00 | 3 |

| Perusahaan Penerbit SBSN Indonesia | Indonesia | Ijarah | IDR | 1,663.74 | 3 |

| Government of Indonesia | Indonesia | Ijarah | US$ | 1,500.00 | 10 |

| IDB Trust Services | Saudi Arabia | Wakalah | US$ | 1,500.00 | 5 |

| Saudi Electric Company | Saudi Arabia | Ijarah | US$ | 1,500.00 | 10 |

| IDB Trust Services | Saudi Arabia | Wakalah | US$ | 1,500.00 | 5 |

| Government of Malaysia | Malaysia | Murabahah | RM | 1,244.77 | 3.5 |

| Saudi Electric Company | Saudi Arabia | Istithmar | SAR | 1,199.87 | 10 |

| Qatar Central Bank | Qatar | Murabahah | QAR | 1,097.00 | 5 |

| Government of Hong Kong | Hong Kong | Ijarah | US$ | 1,000.00 | 5 |

| Government of Pakistan | Pakistan | Ijarah | US$ | 1,000.00 | 5 |

| Saudi Electric Company | Saudi Arabia | Ijarah | US$ | 1,000.00 | 30 |

| IDB Trust Services | Saudi Arabia | Wakalah | US$ | 1,000.00 | 5 |

| Government of Turkey | Turkey | Ijarah | US$ | 1,000.00 | 10 |

| Government of Malaysia | Malaysia | Murabahah | RM | 915.90 | 7 |

| Source: IFIS, Zawya, Bloomberg, KFHR | |||||

In 2015, the Sukuk market is expected to continue to record issuances of more than US$100 billion (2011-2013 average: US$112 billion), and to expand to various countries and sectors. Meanwhile, Sukuk outstanding is expected to grow at the average pace of the past five years (around 16% per annum), to US$348-360 billion in 2015 (see Chart 4). While issuances of longer-term Sukuk with more than 10-year maturities are on a declining trend, the market has seen an increase in the share of three-year to 10-year Sukuks, which would support Sukuk outstanding for several more years.

Nevertheless, financial market sentiment remains vulnerable to external events such as geopolitical crises, especially in the Middle East and Russia; as well as shocks to oil prices. Russia’s economic struggle may cause the country to tap into the Sukuk market as an alternative solution to increase capital and increase its investor base.

| Chart 5: Sukuk pipeline in first half of 2015 | ||||

| Issuer | Country | Region | Currency | Amount, US$ equivalent |

| Central Bank of Nigeria | Nigeria | Africa | TBC | TBC |

| Central Bank of Mauritania | Mauritania | Africa | TBC | 300 |

| Government of Sudan | Sudan | Africa | US$ | 758 |

| Government of Tunisia | Tunisia | Africa | US$ | 500 |

| Islamic Bank of Thailand | Thailand | Asia | US$ | 150 |

| Ministry of Finance | Ireland | Europe | TBC | TBC |

| Islamic Development Bank | Saudi Arabia | GCC | US$ | Up to US$10bln per year |

| Oman Sovereign | Oman | GCC | OMR | 300-400 |

| Morocco Sovereign | Morocco | Africa | TBC | TBC |

| Central Bank of Yemen | Yemen | Middle East | LCY | 233 |

| Asian Development Bank | The Philippines | Multilateral | TBC | TBC |

| Republic of Tatarstan | Russia | Europe | US$ | 100-200 |

| Ras Al Khaimah | The UAE | GCC | US$ | TBC |

| Kazakhstan Sovereign | Kazakhstan | Central Asia | TBA | TBA (1Q15) |

Sukuk outstanding is also expected to increase to almost US$350 billion. While Malaysia is expected to retain its lead, Sukuk outstanding in the GCC will amount to almost US$100 billion. The Sukuk market will be driven by sovereign issuers and infrastructure spending, reflecting mainly the large financing needs of these issuers/projects. Nevertheless, stronger domestic demand in both Asia and the GCC will spur more issuances from services-related sectors (such as F&B and retail), healthcare and education, as seen in 2014. The key challenges for the market include the decline in oil prices, which is an important source of income for the GCC economies; as well as the potential for disorderly exit from easy monetary policies in the advanced economies. Despite these risks, the Sukuk market remains supported by structural factors which will continue to bolster its growth and depth in the medium term.

Saud Al Nafisi is the investment officer, Investment Banking at KFH Investment. He can be contacted at [email protected] .