Australia is small country based on its population but a giant when considering its funds management industry. Hence, I will start with the numbers and put size and market potential into context.

The Australian funds management industry is the largest in Asia with about AU$1.8 trillion (US$1.78 trillion) in funds under management: about twice the size of its nearest Asian rival. To put this figure into an Australian context, it is 20% larger than the market capitalization of the entire Australian equity market (as at December 2009) and 35% larger than Australia’s nominal GDP (as at December 2009).

The growth in Australia’s funds management industry is underpinned by our compulsory retirement savings scheme known as the Superannuation Guarantee Contribution. It requires 9% of every employee’s salary to be placed into a savings scheme of the employee’s choice and can only be accessed once the employee is 60 years of age. In recent years the government has announced plans to increase the compulsory annual contribution to 12%.

The superannuation or retirement savings scheme had a system size of about AU$1.34 trillion (US$1.3 trillion) as at June 2011. In June 2011 quarter alone, AU$23.8 billion (US$23.7 billion) in additional contributions were made to the system. Based on Australian Bureau of Statistics data, about 70% (AU$1.2 trillion/US$1.19 trillion) of superannuation savings are placed with fund managers.

How are these funds invested today?

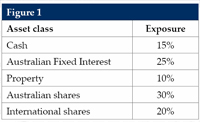

A typical diversified portfolio is likely to be structured as per the table in Figure 1.

Based on a typical diversified portfolio as per the table in Figure 1:

Approximately 40% of the portfolio is invested in interest bearing accounts or securities which is clearly problematic from an Islamic perspective.

Around 10% is invested in property. Most, but not all, listed and unlisted property trusts tend to have gearing in excess of 33%. That said, a number of Australian listed property trusts have publicly stated an intention to bring gearing back down to a more sustainable 20–30% range.

Around 30% is in Australian shares. The financial services sector makes up about 30% of the ASX 300. Eight of the top 20 ASX listed companies are financial services companies; one produces alcohol and another is a large distributor and seller of alcohol – again, clearly problematic from an Islamic perspective.

Crescent Wealth’s approach

The opportunity to leverage the existing investment product range in Australia to meet Islamic investment principles is almost non-existent. Hence, we started with a blank canvas.

Our starting position was to develop a new and innovative suite of Australian based funds based on Islamic investment principles that cover the four major asset classes of Australian shares, international shares, property and cash. The fund had to have a critical base of Australian retail and institutional investors and not be reliant on Asian or Middle Eastern investment funds to be successful.

A suite of investment products needed to be developed that not only met the needs of Australian Muslims but all Australians interested in an alternative in socially responsible investing. Crescent Wealth, Australia’s first Islamic wealth manager, was granted an Australian Financial Services License in December of 2010. In July of this year, we launched the Crescent Australian Equity Fund, the first Islamic Australian equity fund available to retail and wholesale investors in Australia.

The regulatory and commercial barriers to setting up an Islamic wealth manager in Australia are significant. We anticipate others will enter the Australian market but it is likely to be existing conventional institutions rather than new managers like Crescent Wealth that have been established with the sole purpose of providing Islamic wealth management products.

To satisfy regulatory hurdles, it is important for any new manager to establish organizational competence in managing key asset classes or product areas. Crescent Wealth as a team has a unique blend of experience in financial services, funds management, investment banking, private equity and entrepreneurial corporate management.

The Australian opportunity

Crescent Wealth conservatively estimates that the investable universe for Islamic funds in Australia is currently worth AU$4–8 billion (US$3.9-7.9 billion), with potential to grow to AU$7–13 billion (US$6.9 – 12.9 billion) by 2019. We base this estimate on the retirement savings of working Australian Muslims. We conducted a web poll on our website over a number of months and interestingly, 83% (147/177) respondents said that they would switch their Superannuation (or retirement savings) into an Islamic or Shariah compliant investment option, if one existed.

Similar to socially responsible investing, Islamic investment filters out socially detrimental activities, such as gambling, pornography, alcohol and weapons. For the most part, Islamic investing is consistent with conventional socially responsible value-based investing, which mandates social values and good governance. The one key advantage in the Islamic approach is that there is no grey area, the definition of what constitutes socially responsible does not change – unlike some conventional socially responsible funds. As most would know, Islamic investing also screens out the financial services sector, unlike most conventional socially responsible funds.

In Australia the market for socially responsible investing (SRI) is worth US$55.4 billion. From 2000-2006, SRI managed portfolios grew from US$325 million to US$11.98 billion, representing an increase of 3.58%, according to a report prepared for the Ethical Investment Association of Australia.

Crescent Wealth has already secured one socially responsible institutional mandate from Aon Hewitt, the manager of a AU$2 billion (US$1.9 billion) Superannuation Master Trust, to seed the Crescent Australian Equity Fund. We believe this is a significant vote of confidence in our approach and business model especially after a long and exhaustive due diligence by the Aon Investment Committee.

Malaysian investments in Australia

Malaysia is Australia’s third-largest trading partner in the ASEAN region and our 11th largest partner overall. In addition, Australia is also a major educational services provider to Malaysia.

Malaysia is a net investor into Australia with a total of AU$8.6 billion (US$8.5 billion) in investments at the end of 2009.

We don’t have access to the complete list of Malaysia-based Australian equity funds but are aware of two: CIMB-Principal Australian Equity Fund and Public Australian Equity Fund. Based on Morningstar data they have approximately US$30 million and US$93 million in funds under management, respectively. Interestingly, both funds have about 20% of their investments in the Australian financial services sector – not surprising given it makes up around 30% of the ASX 300.

Though Malaysia has the world’s second largest Islamic funds management industry (around US$5 billion), at present, it only makes up about 5% of the total funds management industry. We believe there is a significant opportunity for the Islamic funds industry to grow. Further, a significant opportunity exists for Crescent Wealth to partner with Malaysian institutions to invest in Australia through Islamic investment vehicles, rather than conventional.

Crescent Wealth’s approach to Islamic investing in Australia

We have appointed Amanie Islamic Finance Consultancy and Education as the Shariah Supervisory Board for the Crescent Australian Equity Fund. Dr Daud Bakar is a key scholar at Amanie and hence an advisor to Crescent Wealth.

Each month, in cooperation with our partners, we screen the Australian equity market for Islamic qualitative filters (e.g. alcohol, financial services, gambling, etc) and then quantitative filters (e.g. debt) and provide a list of about 200 – 250 stocks to our portfolio manager. This list then represents the ‘investable universe’ for our portfolio manager and enables them to apply their commercial, quantitative and other filters and select appropriate investments.

The future for Islamic investing in Australia

As a first mover in Islamic wealth management in Australia, we are pioneering a new sub-sector of the Australian funds management industry. We plan to launch three more funds sometime in the first quarter of 2012 which will form the basis of our Islamic Superannuation product (again, a first for Australia).

The Australian government is very supportive and encouraging of the Islamic funds management sector as they see the significant opportunity. If Crescent Wealth were to achieve its goals, Australia would be firmly placed to join Islamic funds management heavy-weights like Saudi Arabia, Malaysia and the UAE as part of the global top five Islamic funds management markets.

Chaaban Omran is the former managing director MCCA, former CEO of Crescent Wealth, and is the current director of investment & superannuation at Crescent Wealth. Chaaban is also a Fellow of the National Institute of Accountants and an Associate Fellow of the Australian Institute of Management. He can be contacted at

[email protected]

.