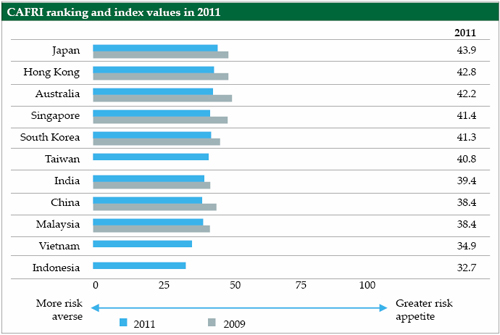

The survey aimed to identify changes in consumer risk attitudes, comparing them to the results of an inaugural study conducted during the global financial crisis in 2009, using the Swiss Re consumer appetite for risk index (CAFRI).

Malaysia saw a slight decrease in its CAFRI rating, with its index values amongst the regions lowest at 38.4 in 2011. The higher the index value, the more willing consumers are to take risks, and vice versa.

The study highlighted a growing trend in the need for insurance and financial planning, fuelled by worries about medical expenses and the risks associated with increasing longevity. Also noted was that perceived cost remained the greatest barrier in buying insurance.

For the Asia-Pacific insurance industry, the 20-40 year old age bracket are not only the future buyers of insurance, but also represent tremendous business opportunities now. This is especially true in the case of Malaysia, where the 15 – 64 year old age bracket accounts for 65.4% of the population, with the median age standing at around 28.6 years.

The survey also turned up a few surprises, suggesting that respondents from developed markets tend to be more willing than their emerging market peers to take risks, due to the availability of better social security systems.

The study shows that around 40% of respondents across the region say their families would or might struggle financially in case of early death, major serious illness or disability in the family.