The 2021 financial year saw a transition from a vaccine-fueled and policy-led recovery to a more fundamentally-driven expansion. Equity markets’ performance remained fairly strong, even amid supply chain disruptions, inflationary pressures and ongoing virus concerns. In the 2022 financial year, the economic growth is expected to moderate, monetary policy is expected to prioritize taming inflation and corporate earnings growth is expected to continue driving equity market returns.

The waves of high valuations and low volatility, which offered higher returns and lower risk for entrepreneurs, resulted in exceptional primary activity. While IPO waters are expected to continue to flow, 2022 will be a year of change as price-sensitive; environmental, social and governance (ESG) and long-term value investors could shift the tides for IPO candidates.

Review of 2021

2021 was another exceptional year for equity markets. Most of the stock markets returned a solid performance on the back of highly accommodative fiscal and monetary policies coupled with a strong economic and earnings rebound during the course of the year. Time and again, investors brushed off news that could have derailed the stock market rally, contradicting naysayers who forecasted a correction that never appeared. Neither the still-raging global coronavirus pandemic with its Delta and Omicron variants nor high inflation and supply chain disruptions stopped stocks from notching all-time highs, many times during the course of the year.

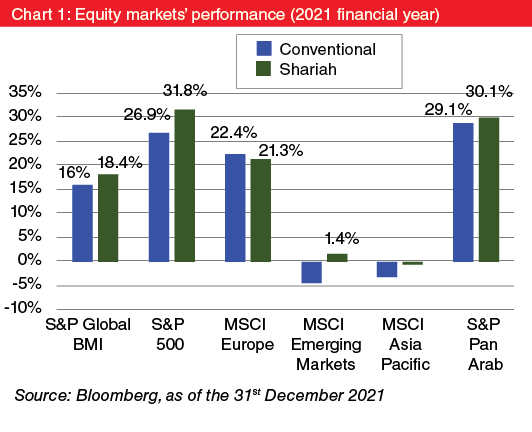

The global stock market represented by the S&P Global Broad Market Index generated 16% in 2021, Americas (S&P 500 Composite Index) gained 27%, Europe (MSCI Europe Index) gained 22% while Pan Arab markets (S&P Pan Arab Index) gained 29% despite high valuations. However, the emerging markets (MSCI EM Index) bucked the trend by declining by 5%.

The Islamic equity markets outperformed their conventional counterparts across all major regions (See Chart 1) owing to the weak performance of the financial sector which tends to have significant weight in the proxies of conventional equity markets. The outperformance can also be attributed to technology, healthcare and consumer discretionary sectors delivering better yearly performance, eking out relatively small gains on the back of their overweight position in Islamic market proxies.

2021 was the most active year for the global IPO market over the past 20 years. It began with coronavirus vaccine rollouts, a rebound of global economies and rolling liquidity in the market hastened by government stimulus programs resulting in optimism. The strong post-listing performance of newly listed companies further boosted market sentiments.

The global primary market in 2021 saw approximately a total of 2,400 deals raising around US$500 billion in proceeds. Most of the primary market issuances are Shariah compliant, as a majority of them belong to technology, health and industrial sectors and are lower components of debt in their capital structure.

All global markets experienced overall increases by both IPO volume and proceeds, but Europe, the Middle East, India and Africa produced the highest growth, seeing a 158% increase by number of IPOs (724) and a 214% increase by proceeds (US$109.4 billion).

The Americas remained hot as well, ending the year with 528 IPOs raising US$174.6 billion by proceeds, an 87% and 78% increase respectively. The Asia Pacific region experienced relatively modest growth, resulting in 1,136 IPOs (28% increase) and raising US$169.3 billion by proceeds (22% increase).

Globally, the technology sector saw the highest number of IPOs (600-plus) and highest proceeds (US$150 billion approximately), followed by healthcare that raised the next highest number of IPOs by volume and proceeds, seeing 375-plus IPOs raise over US$65 billion by proceeds.

The industrials sector was close behind healthcare, with 300-plus IPOs raising over US$63 billion by proceeds. Major issuances of 2021 include cryptocurrency exchange Coinbase, online brokerage Robin Hood and Tesla rival Rivian — these were among firms captivating investors and fueling a record-smashing wave of IPOs and direct listings.

The global IPO activity slowed its frenetic pace toward the end of 2021 with the surfacing of the Omicron variant, continuing geopolitical tensions, new government policies and regulations and increased market volatility, signaling challenges that lie ahead.

Preview of 2022

2022 will be a critical year in which the imbalances, wrought by the pandemic in the form of significant divergence between economic well-being and stock market performance, will likely begin to resolve and normalize. There will be a transition not just to a post-pandemic reality, but also to more normal monetary policy, and to more moderate returns on financial markets.

Looking ahead, both headwinds and tailwinds are in sight and are likely to impact the direction of equity markets. A combination of monetary and fiscal policy shift leading to interest rate hikes on the back of persistent inflation risks coupled with the pace of quantitative easing to such liquidity, new variants of the ongoing coronavirus pandemic and consequent business restrictions could hamper full economic recovery.

On the other hand, the global economic growth looks set to be above trend again in 2022, as social distancing rules are relaxed further and the consumption of services such as restaurants or travel should pick up, supporting the services part of the economy. Strong goods demand should result in a pickup in production once supply chain problems start to ease.

As a result, industrial production looks set to increase as well. Inflation should normalize from the elevated numbers of 2021, though it will likely remain above pre-pandemic levels with the easing of supply chain problems and labor mobility. Economic optimism will lead to higher corporate earnings and drive stock markets to deliver positive returns.

The primary market can expect higher market volatility and it will be imperative for listing aspirant companies to adopt a resilient and flexible strategy amid shifting market conditions, evolving regulations and geopolitical tensions.

There are still plenty of reasons to believe that the primary market will be strong in the 2022 financial year. There is an abundance of IPO-ready companies thanks to a decade-long buildup of venture-backed start-ups with trillions of dollars spent on them. The pipeline in the new year includes mega-IPOs such as the following: payments processor Stripe which is expected to hit the market with a US$100 billion valuation; grocery delivery service Instacart, which was originally hoping to dive into public markets last year, likely to raise in 2022 a rumored valuation of US$50 billion; San Francisco digital bank Chime which is eyeing a US$45 billion evaluation; social media platform Reddit (a US$15 billion valuation) and yogurt maker Chobani.

IPO plans are also reportedly in the works for Porsche, Indian e-commerce giant Flipkart, precision medicine company Tempus Labs and Indonesia’s GoTo Group, etc. Gen-Z favorite TikTok will likely be going public at some point in 2022, although there are no concrete details yet.

The increasing number of investment opportunities in the primary market is likely to make investors more selective and price-sensitive. The unicorns need to satisfy investor demands for resilient growth strategies, stable profit generation, cash-flow visibility and well-articulated ESG plans. The companies also need to be prepared to offer at reasonable valuations to retain investor attraction unlike last year.

Conclusion

Against all odds, the outlook for the equity market still presents compelling value relative to other asset classes, given the lower interest rate environment in the near term. Corporate earnings growth will likely be the most important driver of equity returns in 2022. However, investors have to be cautious and selective, as monetary stimulus programs are scaled back, and if global growth slows sharply, markets could be heading for a correction and high-priced/overvalued companies will feel the pain much faster than others.

The views and opinion expressed in this article are those of the author’s independent personal opinion and should not be construed to represent any institution with whom the author is affiliated. You should not treat any opinion expressed here as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of an opinion.

Dr Mohammed Ishaq Ali is the head of equity funds at ANB Invest, Saudi Arabia. He can be contacted at [email protected].