Structure

KT Turkey Sukuk (Issuer SPV) was incorporated in the Cayman Islands and issued as an asset-based Wakalah Ijarah-Murabahah.

The issuer SPV acquired a beneficial interest in an asset pool (portfolio assets) comprising a mixture of maximum 49% Murabahah and minimum 51% of Ijarah receivables. The Sukuk was issued under English law and listed on the London Stock Exchange.

Kuveyt Turk is ultimately liable for the due and punctual payment of all sums payable to the certificate holders and undertook to repurchase the beneficial interest and rights in the portfolio assets in full at maturity. Kuveyt Türk’s payment obligations under this transaction will rank at least equally with the claims of all of its other unsecured and unsubordinated creditors.

2011 — Legislative works

In February 2011, the Turkish Parliament adopted tax neutrality measures for Sukuk Ijarah. The law reduced the withholding tax on such Sukuk to 10% and exempted sales from value-added, stamp and corporate taxes, according to Osman Nihat Yilmaz, the assistant secretary general of the Participation Banks Association of Turkey. It applies however only to Sukuk Ijarah.

“Additional legislation exempted Sukuk certificates with a minimum tenor of five years from taxes on revenue,” said Ali Sanver, a partner at Istanbul-based law firm Pekin & Pekin. Notes with shorter maturities would still be subject to a tax rate ranging from 3-10%, putting them on a par with non-Islamic bonds.

Kuveyt Turk has a second primer: ‘Turkish delight’

General

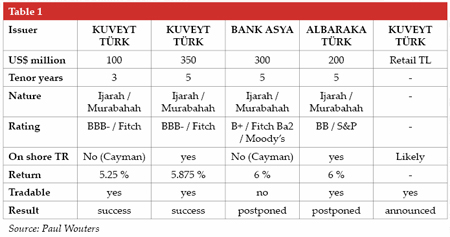

In October 2011, a five-year Sukuk Wakalah Ijarah-Murabahah 2011/2016, worth US$350 million, was offered with success. This was at the same time: [1] the first offering under the new Turkish Sukuk Ijarah standard, [2] a primer for the five-year maturity and [3] the first (partly) asset-backed Turkish Sukuk.

The allocation was 19% to Asian investors, 69% to Middle Eastern investors and 12% to European investors; comprising 81% to banks, 10% to sovereign wealth funds and supranational agencies and 8% to fund managers and insurance firms.

The transaction was priced at par with a profit rate of 5.87%, which was more competitive than the pricing for equivalent bonds issued by Turkish conventional banks such as Akbank T.A.S. and Isbank during same reference period.

Structure

KT Sukuk Varlik Kiralama (issuer SPV), established in Turkey, used the proceeds to acquire a portfolio of 51% real estate Ijarah assets (including the head office building) and non-real estate Ijarah assets and further, for a maximum of 49% out of Murabahah receivables.

Kuveyt Turk will lease-back the real estate Ijarah assets and will pay rent to the issuer SPV who will in turn pay the profit distribution to the certificate holders. Kuveyt Turk, said Fitch, is ultimately liable for the due and punctual payment of all sums payable to the certificate holders. It further undertakes to purchase the portfolio assets back from the issuer SPV against the exercise price at maturity.

Kuveyt Turk’s payment obligations under this transaction will rank at least equally with the claims of all of its other unsecured and unsubordinated creditors.

Bank Asya tiptoes into the deep waters

General

Bank Asya Participation Bank launched its first Sukuk effort at the end of October 2011.

The yield of the envisaged five-year Sukuk Ijarah-Murabahah 2011/2016, worth US$300 million, was expected to stay below 6%. The November 2011 roadshow was reported to have attracted decent but overly expensive interest from the international finance community, so the offering was temporarily postponed.

Bank Asya is financially sound, as underlined by the affirmation in November 2011 by Fitch of Bank Asya’s long-term foreign and local currency issuer default ratings of ‘B+’, as would also be the rating ‘B+’ of the envisaged Sukuk.

Structure

Bank Asya opted to launch an offshore asset based Sukuk Ijarah-Murabahah. A Cayman-based special purpose company (issuer SPV) would use the Sukuk proceeds to purchase a portfolio of assets consisting of obligations owed by Bank Asya’s customers that would be used to service the coupon payments due on the Sukuk.

Bank Asya was to guarantee due and punctual payment of the sums payable to the Sukukholders. At maturity, Bank Asya would purchase the portfolio of assets back from the issuer SPV at a price equal to the full price of the Sukuk. Bank Asya’s payment obligations under the transaction would rank at least equal with the claims of all its other senior unsecured and unsubordinated creditors.

AlBaraka Turk makes a first attempt

General

AlBaraka Turk entered the arena in November 2011. An issuance of US$200 million was tabled with an expected pricing of 6%, which some bankers stressed was reasonable and competitive in the reigning tough financial environment.

The ‘BB’ rating by Standard & Poor’s was in line with AlBaraka Turk’s overall rating and was said to reflect the bank’s irrevocable undertaking to repurchase the assets held by the issuer SPV at maturity, with an exercise price equal to the aggregate face value of certificates outstanding. That obligation would rank pari passu with all the bank’s other senior unsecured obligations. As for Bank Asya, pricing concerns resulted in the issuance being postponed. The yields expected by the investors were too high.

Structure

The Sukuk were to be issued according to the new Turkish Sukuk Ijarah regulations by Bereket Varlik Kiralama Anonim Sirketi (issuer SPV) incorporated in Turkey as a joint stock company, with an application made to list at the London Stock Exchange.

The issuer SPV would invest at least 51% of the proceeds in a pool of selected real estate assets owned by Albaraka Türk, namely its headquarters and 19 branches. The remaining amount would be invested in a pool of non-real estate-based assets, Murabahah receivables from Albaraka Türk’s customers.

The issuer SPV was to lease back the real estate assets to Albaraka Türk which subsequently would make lease payments every six months to the issuer SPV that would serve as the sole basis for the periodic distribution payments on the Sukuk certificates.

Albaraka Turk undertook to repurchase the assets at maturity at the exercise price that would be equal to the aggregate face amount of certificates outstanding.

What is coming up in 2012?

Finally the groundbreaking sovereign Sukuk?

The Turkish sovereign entry to the international Sukuk markets has been eagerly awaited for some years now. The financing of the envisaged Third Bridge over the Bosporus was silently earmarked for the occasion and – as has been more or less officially revealed by several sources now – this appears to be scheduled still this year.

Corporate Sukuk

In February 2012, Kuveyt Turk announced its third Sukuk to be issued this year. It appears to hold another exciting first: a domestic retail Sukuk in Turkish lira.

Murat Cetinkaya, the deputy chief executive of Kuveyt Turk, said: “There is a need for a lira Sukuk in the domestic market. A lira Sukuk would provide an opportunity to individual or institutional investors who are looking for an interest-free instrument.”

Kuveyt Turk will also be working with Capital Markets Board of Turkey and the Istanbul Stock Exchange for a dual listing of its Sukuk on the London and Istanbul stock exchanges. Both previous issuances are already listed on the LSE. The bank also confirmed its intention to provide consulting services to firms who plan to issue Sukuk in Turkey.

A recent report has revised the status of Albaraka Türk shares to “outperform with upside potential of 31%”. Depending on market conditions, Albaraka Türk has announced its plans to have another go, maybe still in the first half of 2012. The banks has also announced its intention to plan another round this year in the same period.

Conclusion

2011 has been a landmark year for Sukuk development in Turkish participation banking. More issuances, both by the participation banks and by the Turkish government, are either already announced or are clearly in the pipeline.

As talks about Islamic finance in Turkey grow louder, a regional Istanbul Islamic Capital Market could be waiting around the corner as a part of the upcoming Istanbul International Financial Center. This would be supported by the potential available in the local Turkish market both in demand (growing business needs) and supply (growing savings) and the fast expanding intra-OIC trade volumes.

Indeed, in line with the present active deployment of the 1991 OIC Trade Preferential System efforts, Turkey’s trade with the Middle East and North Africa is said to have surged six-fold since 2002, reaching US$30 billion last year, and this with a GDP average growing around 6% per annum. Notwithstanding the present developments in the international financial markets and a somewhat volatile Turkish lira, the prospects for the Turkish Islamic banks and the underlying real economy are excellent.

The seeming absence in the Sukuk markets so far will proof to be a real advantage, given the fact that no historic burden of outdated Islamic financial engineering has to be carried along, which allows spearheading.

Paul Wouters is a lawyer with Lawyer Antwerp Bar Association (Belgium), a senior foreign counsel at Azmi & Associates (Malaysia / Singapore) and the CEO of Senturiyon Global (Jakarta — Indonesia). He can be contacted at

[email protected]

.