Indonesia’s Shariah mutual fund industry began in 2000 with the launch of PNM Syariah, a balanced fund that was shortly followed in the same year by Danareksa Syariah Berimbang, also a balanced fund.

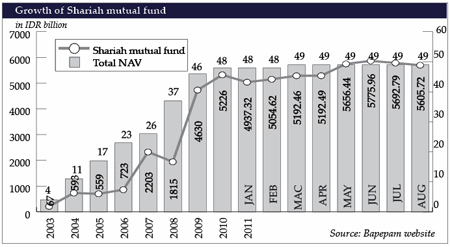

According to statistics released by Indonesia’s Capital Market and Financial Institution Supervisory Board (Bapepam-LK), as at the 31st August 2011 there were 49 Shariah compliant mutual funds in the country, representing only 7.8% of the industry’s total number of mutual funds.

The industry remains domestic-centric and should continue to do so. Being the most populous Muslim nation and a market-driven industry, fund management companies continue to focus on retail funds to suit the palate of its target market – retail investors. There are currently a total of 21 fund managers offering Shariah compliant funds in the country with Mandiri Manajemen Investasi having the most among the managers; with 12 funds.

The year of global economic uncertainties is seeing investors turn towards safer investments, Indonesia being no exception. Investor interest is reportedly increasing in fixed income and capital protected funds. This is evident from two funds launched in the first quarter of 2011: Mandiri Protected Smart Syariah Seri I & II.

However, the global attraction towards Indonesia is overwhelming. One analyst views the country as still being a difficult place to do business because of poor infrastructure and “non-transparent random regulations,” but there are signs that things are changing for the better as it is still attractive to foreign investors.

This begs the question, where are these foreign investors? Masniari Sitompul, a partner at Roodiono & Partners, cites the possibility of a lack of foreign investor awareness and understanding which could be inhibiting them from venturing into the Indonesian market. She says there are currently no regulations preventing or limiting foreign investors from investing in Shariah mutual funds.

The biggest hurdle faced by fund managers, it seems, is the lack of underlying assets available in the market. This issue was raised in a report quoting MQ Gunadi, the president director of PNM Investment Management. He was quoted as saying that even if such assets were found, they usually contradicted with existing regulations that limit investment to a 10% maximum of one company’s Sukuk.

Leoni Silitonga, another partner at Roosdiono & Partners, also feels that Indonesia needs to increase or further develop Shariah compliant instruments for the market. “Only then will fund managers have the flexibility and opportunities to invest in Shariah securities. Currently there are only a few Shariah instruments/ securities and this also affects the development of the mutual fund industry.”